This writer has been giving ‘ceramahs’ (political rallies) in a number of Felda settlements like Ulu Tebrau, Johor and Kg Batu 13, Jengka, Pahang. He now subjects some of the issues he has been raising in the ceramahs to the scrutiny of others.

Lest he be accused of insinuating and instigating the Felda settlers (peneroka) to ‘revolt’ against what is in fact the biggest IPO ever seen in the history of Bursa KL listing, he now stands to be corrected in all his assertions. Motivated by ‘only giving the best’ to the rakyat (read here Malay Felda settlers) he now challenges Najib and his Cabinet to prove him wrong.

Let’s get down to business.

For all the sweat, tears and sometimes blood, especially for the first generation of settlers who had pioneered and opened virgin forests in the face of elephants, wild-boars and tigers, what really are the ‘windfalls’ in real terms ie RM and sens?

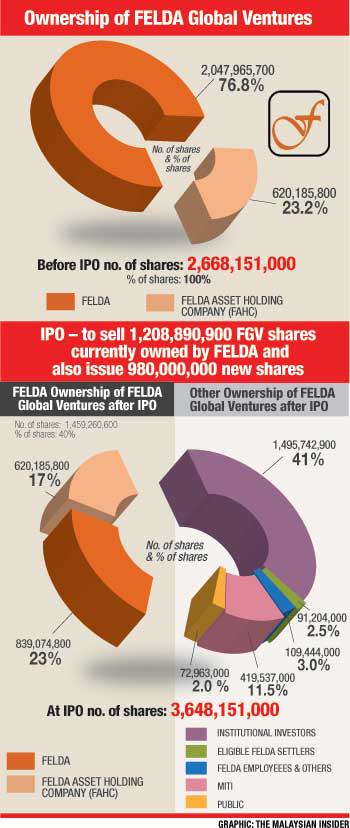

From the graphic illustrating Felda Global Venture Berhad (FGVB) shares both pre- and post-IPO, very evidently, Felda settlers are to be given 2.5 per cent of the entire shares of the listing exercise of the FGVB ie 91,204,000 of the entire 3,648, 151,000 shares.

With 60 per cent of the share to be sold to ‘others’ at an IPO price of RM 4.65, the total fund to be raised by FGVB would be around RM10.2 billion. Institutional investors take the lion’s share, supposedly forming the financial backbone of the newly minted Public Listed Company (PLC).

More pertinent to our debate is the fact that at two per cent of the total shares (ie 91,204,000 shares) allocated for the 112,635 settlers, each settler is to be allocated 810 shares. If after the IPO, the counter makes a premium of RM1 (say a price of RM5.65), each settler-peneroka is in to make a pathetic RM810 for the shares allocated to each of them.

The 23,000 Felda employees are quite obviously better compensated. Allocated three per cent of the total shares (ie 109,444,000 shares) and assuming it’s pro-rated, each is in to be given 4,700 shares.

The idea of advising settlers not to sell their shares but instead hope for yearly dividend is even more baffling and misplaced, as if settlers are keen followers of the Bursa and surely oblivious to a lot of ‘downsides’ as this writing might touch on.

Very fortunately, Najib was wise enough to provide for a ‘windfall’ of RM15,000 to be divided between three recipients: father, mum and a named child. Even with the ‘windfall’ and the 100 per cent guaranteed financing from participating banks, settlers are quite evidently short-changed. It will be more obvious as argued below.

Let’s begin with the issue of shares apportionment. Well, in all fairness, it must be reminded that, as usual, a great chunk of the shares are apportioned to MITI which in turn is responsible to ‘distribute’ it to bumiputera high net-worth individuals and bumi companies.

Some 11.5 per cent of the total shares are designated for this purpose amounting to 419,537,000 shares. At a premium of RM1 per share after two weeks of trading say, and with a PE ratio of 16 or higher (Price-Earning ratio denotes ‘upside’ of one’s investment), these individuals and companies are in to make a cool RM420 million. How lucky!

My question submitted for the minister of finance to be verbally replied, should we convene for the next parliamentary session (11 June-28 June), is for him to reveal who these individuals are and the names of the companies. These individuals are either truly high-net worth or are arguably ‘politically right’ or as claimed by many, usually Umno politicians and Head of Umno divisions and leaders of sort, all anxiously waiting for their ‘windfall’.

In that sense, the IPO of this FGVB has been eagerly awaited and must be executed “at all costs” before the dissolution of parliament. While Umno top leaders are said to be already armed to the teeth with RM, division leaders are not apparently well greased. With this IPO, market talk has it, that Umno is roaring to go.

In other word, is this listing about a company resorting to the equity market to raise funding by floating their shares for some clear expansionist strategy or is it merely to ‘unlock value of assets’ (read stripping its) land taken in the name of the ‘rakyat’ (settlers) now leased for 99 years, as to fill ‘political coffers’ to grease election machineries. While this might sound very presumptuous, it is merely paraphrasing the writings many concerned citizens in the alternative and social media.

Back to the issue of why settlers are allegedly to be ‘short-changed’ by the opposition namely Pakatan and various NGOs like ANAK.

While the short-term gains to the Felda settlers are arguably substantive, yet small in relation to others, they in fact will suffer more in the long run. They have to trade-off some of the large annual financial supports directly or indirectly received from Felda entities which are going to be listed.

To recap, the Felda settlers have a moral right to the 360, 000 hectares of land which is about to be leased to FGVB for 99 years by Felda. This land was allocated to Felda for the purpose of its resettlement programmes, provided for by the Group Settlement Act — GSA (1956), but they were not allocated to settlers on the usual basis of 10 acres per family from 1980 onward.

Instead, the extra land was retained by Felda and operated as commercial plantations, with proceeds effectively used in support of settlement and other activities, as well developing downstream and related businesses. State governments apportioned state land for the interest of settlers at heart. Currently, Felda controls 811,140 hectares of land, with 57 per cent belonging to settlers and the rest directly owned and operated as commercial plantations (43 per cent or 360,000 hectares).

Thus Felda’s second and third generations, who might want agricultural land, have lost the last hope for access to Felda’s land bank via this listing. Assuming 10 acres per settler, the plantation land leased to FGVB could instead accommodate some 80,000 new Malaysian settler families, if Felda were to resume its original mission. Admittedly, this idea has been mooted by Pakatan Buku Jingga.

Incidentally, the Koperasi Permodalan Felda (KPF), which represents the interests of the settlers, had been evidently left out of the FGVH listing exercise. While there is market talk that KPF will receive 17 per cent of FAHC shares after listing, this was not spelt out in the prospectus of the FGVB and has yet to be verified.

For the record, KPF is the 51 per cent shareholder of FELDA Holdings Bhd (FHB), while FGVH, a wholly-owned subsidiary of the FELDA statutory body, holds the balance of 49 per cent. The co-operative is 70 per cent owned by FELDA settlers while the remaining 30 per cent is owned by employees.

Prior to 2010, the government statutory body FELDA owned 355,864 ha of plantation land, which was managed by FELDA Plantations Sdn Bhd, a 51 per cent subsidiary of FHB. The remaining 49 per cent, he said, was owned by FELDA.

The 355,864 hectares of plantation land in question had generated handsome income yearly for FHB and because KPF owns 51 per cent of FHB, a regular source of income is similarly generated for KPF.

While FGVB would be paying both the lease rent for the next 99 years to FHB and revenue from profit-sharing accrued, there is hardly any guarantee that it will be able to maintain performance before listing. It is noted that 51 per cent of trees are older than 21 years old and do not bode well for the future of FGVB to return high dividend.

An estimated quantum of RM2.6 billion were bandied around for trees to again be planted as to be returning good yield. On a longer time horizon, scenarios are not as bullish and ‘rosy’ as compared to now, where cash given has truly blinded settlers’ longer term judgment.

The question on the discerning mind would be whether this revenue will compensate amply for the loss of profits to KPF, once upon a time enjoyed by all settlers, by which Felda built recreational facilities, schools, and training centres in Felda settlement schemes and diversified into numerous upstream and downstream activities to raise revenues. FGVB

Whether lease payment truly reflects the value of the Felda’s asset injected, to similarly-comparable plantations on leasehold to others, couldn’t be ascertained with any degree of certainty except by an independent party.

In all these arguments, the Najib-BN government is short-changing the settlers and the KPF is at best irresponsible and scandalous at worst.

No comments:

Post a Comment